From 1 August 2021, there will be further changes to the Coronavirus Job Retention Scheme (CJRS) with the level of the grant being reduced and employers asked to contribute 20% towards the cost of furloughed employees’ wages.

The Coronavirus Job Retention Scheme (CJRS), which is also known as the ‘furlough scheme’, was introduced in the spring of 2020 to reduce redundancies and unemployment by helping employers to keep staff during lockdown.

The government has been paying 80% of the wages of people who couldn’t work, or whose employers could no longer afford to pay them – up to a monthly limit of £2,500.

Earlier this year, the Government extended the Coronavirus Job Retention Scheme for furloughed workers until 30 September 2021 when the scheme will be closed.

Changes from 1 August

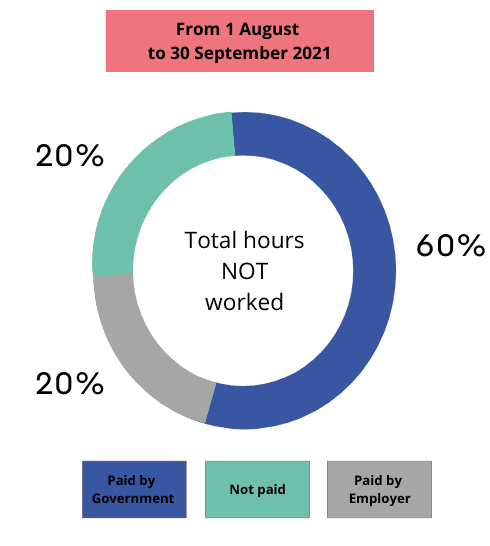

For the last two months of the scheme, the grant will reduce to 60% with the employer contributing 20% to the employee’s wages.

The maximum grant for this period will be £1875.00 per month.

If you bring an employee back part-time, your claim will need to show how many hours the employee would normally work, as well as the number of hours actually worked.

For more details please visit gov.uk.

| If you have any questions regarding the Coronavirus Job Retention Scheme, please do not hesitate to contact us. |