Benefits in Kind are non-cash-related items or services which are considered to be of personal benefit to an employee or Director in addition to their salary and must be declared to HMRC on a P11D form.

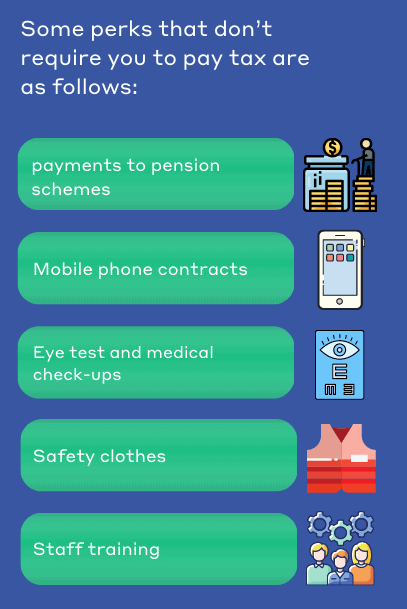

Benefits in kind can include a whole range of benefits, some of these are taxable whilst some of them will not be.

Benefits in kind can be a good way of attracting new employees since they can help towards creating a good salary package.

Blue Spire can help you work out the benefits you can receive as a director of a limited company as well as the taxes that you must pay.

Examples of what counts as a Benefit in Kind

Some of the most common benefits that can be taxed are included in the below video:

There are many rules around these benefits and which items require you to pay tax so if you are unsure then please get in touch with us here at Blue Spire and we can advise you on what to declare on your P11D form.

How Can You Pay Tax on Benefits in Kind?

The majority of employees do not need a P11D. If however, an individual received benefits personally during a given tax year, the employer will need to file a P11D to HMRC.

Once the P11D form has been submitted, the value of the benefits are assessed, then the Employer must pay class 1A National Insurance on their value. In addition, the employee’s tax code will be adjusted and additional income tax will be deducted from the employee’s salary.

You must file your P11D by 6 July following the end of the tax year. For example, if you provide perks to your employees in the tax year of 2021/22, you’ll have to report them by 6 July 2022.

In addition to this form, you will also need to complete a P11D (b) document to accompany the P11D form, which allows you to pay Employer’s National Insurance Contributions on the benefits.

Penalties

If you miss the deadline of 6th July (either online or on paper) and you contact HMRC to let them know, you will be given two weeks to file your form before you incur a penalty. Once this time is up, if you have still not filed your P11D, then your company will incur fines of £100 per month per 50 employees.

If HMRC have still not received your P11D form by November then they will send you a reminder, along with details of all the penalties you’ve accrued up until then.

If your P11D is filed incorrectly, you could also incur a penalty. However, if the mistake was genuine, and HMRC believes you took reasonable care before filing, you might not face any fines.

How Blue Spire can help:

We have many years of experience helping our clients to pay their taxes on time and we can complete and file these forms on your behalf or provide advice should you have any queries regarding the reporting requirements.

| Please contact us as soon as possible if you have any queries around any of the above matters. |