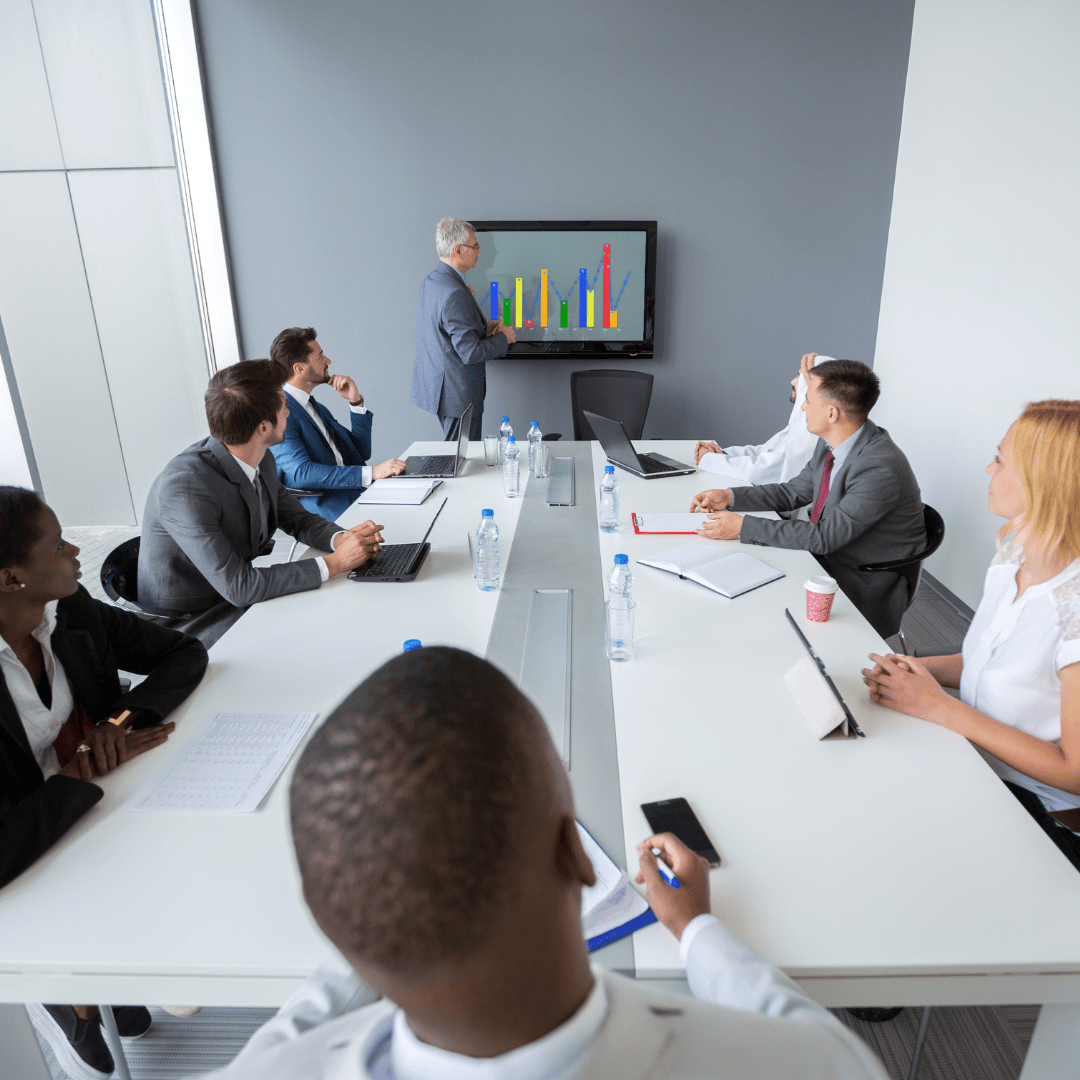

In September 2021, the government announced an increase to the rates of dividend tax by 1.25% from 6 April 2022 to help fund the new planned investment in health and social care.

Dividend payments can be confusing, especially because you pay a different rate of tax on dividends, then you do on your other income.

In this blog, we explain what dividends are, who can take them, and what you need to know about paying tax on them.

What are dividends?

A dividend is a payment a company can make to shareholders if it has made sufficient historic profits which it means it has reserves to distribute.

In basic terms, reserves are the excess of assets over liabilities, or what remains in the business once all taxes, expenses and liabilities have been paid.

Who can be paid a dividend?

When you start a business, you will need to appoint shareholders and assign shares. You may be the sole Director or shareholder of your company or you may have several shareholders.

As a shareholder, you are entitled to be paid dividends from your business provided the company is in profit.

How much should dividend payments be?

As the dividends are paid from the company, the level of payments may vary depending on how much distributable profit is available.

If the company does not have enough distributable profit, it cannot make dividend payments otherwise your company may find itself in trouble with HMRC for making what is known as “illegal dividends”.

It is also advisable to make sure there is enough money in the company to cover cash flow before you pay yourself or your shareholders a dividend.

Corporation tax

Dividend payments are a way that a company can distribute profit to shareholders. The company must first deduct any business expenses including employee wages, company insurance etc from its income to calculate its profit. Once this is done, corporation tax is paid on the profit, before any dividends are issued.

What is left once the corporation tax is paid, can then be paid as a dividend to the shareholders.

How often should you make a dividend payment?

There are no rules around how often you can pay your shareholders a dividend. Shareholders can also receive these payments at different times and for different amounts, depending on their stake in the business.

In larger companies, shareholders of a company will usually declare dividends at the company’s Annual General Meeting. This is done once the annual accounts have been approved and the shareholders can ensure that the company has sufficient available funds.

A company may also opt to pay dividends periodically throughout the year if they can ensure that profits are sufficient to meet day-to-day costs and expenses.

Directors will often opt to take a smaller salary and in addition, receive a higher dividend payment when the company is making a profit.

How are dividends paid?

To issue a dividend to a shareholder of your company, you must:

- hold a shareholder/directors’ meeting with all shareholders present to approve and ‘declare’ the dividend

- make sure that you keep minutes of the meeting, even if you are the only shareholder

Dividend vouchers

For each dividend payment the company makes, you must issue a dividend voucher showing the:

You must give a copy of the voucher to each shareholder receiving the dividend and keep a copy for your company’s records.

Tax on dividends

Your company will not need to pay tax on dividend payments. But shareholders may have to pay Personal Income Tax if the dividend payments are over the tax-free threshold.

Currently, in the 2022/23 tax year, you can earn up to £2,000 in dividends tax-free, in addition to your Personal Allowance for income tax.

Once your dividend allowance and your personal allowance have been used up, dividends will be taxed at a lower and a higher rate band, depending on the amount of the dividend payment and the tax bracket you fall into.

See our below table for current Tax threshold rates for the 2022/23 tax year:

| Tax Threshold | Tax Threshold Value | Dividend Tax Rate 2022/23 |

| Personal Allowance (no tax paid on income in this band) | £0-£12,570 | 0% |

| Basic Rate | £12,571 – £50,270 | 8.75% |

| Higher Rate | £50,271 – £150,000 | 32.5% |

| Additional Rate | £150,001+ | 38.1% |

As a shareholder or director, it is worth having a good understanding of how dividends work and the rules surrounding them, as well as keeping good records for the company and your own personal Self-Assessment.

If you do not have sufficient evidence that money you have received from the business is a dividend payment then HMRC may consider it to be a salary payment and tax it at a higher rate, which could end up being a very costly mistake.

If you need any advice on dividend payments, Blue Spire can help. We can also provide the documentation you need to record the payments.

Please get in touch with our friendly team today.

* Above tax rates are for the current 2022-23 tax period