With the end of the Coronavirus Job Retention Scheme (CJRS) nearing and many employees set to return from furlough, some businesses are left with tough decisions to make on whether they can afford to keep staff on, or whether they will need to consider redundancy as an option.

The Coronavirus Job Retention Scheme (CJRS), which is also known as the ‘furlough scheme’, was introduced in the spring of 2020 to reduce redundancies and unemployment by helping employers to keep staff during lockdown.

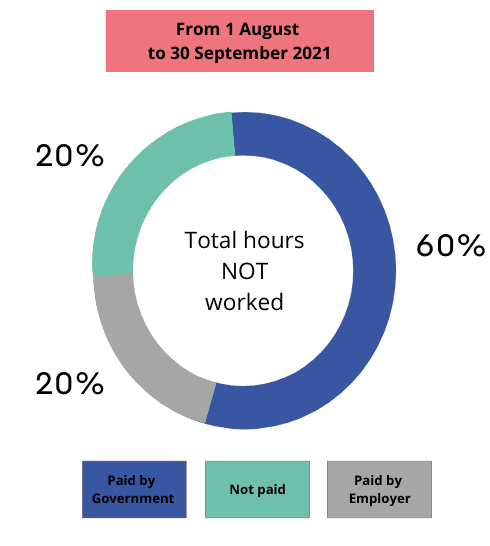

The government has been paying 80% of the wages of people who couldn’t work, or whose employers could no longer afford to pay them – up to a monthly limit of £2,500. This amount has been gradually reduced over the past few months with employers contributing 10% then 20% of employees wages and the Government paying up to £1875.00 per month.

With the scheme due to end on September 30, we take a look at the procedures and rules around redundancies.

What is redundancy?

Under the Employment Rights Act 1996, redundancy arises when employees are dismissed because:

- the business is closing, or has already closed

- the business is changing the types or number of roles needed to do certain work

- the business is changing location

In other words, the business reasons for redundancy do not relate to an individual but to a position(s) within the business.

First step

The first step of the redundancy process is to check and consider the following:

The Employer will need to put together a redundancy plan that will be circulated to all staff and put into action. This will ensure that the company has followed a fair and thorough process and will avoid the risk of legal claims.

Consultation – legal requirements

A key feature to a fair redundancy is the consultation process carried out by employers.

It is good practice in all organisations, regardless of size and number of employees to be dismissed, for employers to consult with employees or their elected representatives at an early enough stage to allow discussion as to whether the proposed redundancies are necessary at all.

As soon as it is possible, employers should inform the employee/s that they are considering making redundancies.

A meeting should then be held with all employees that may be affected, not just those at risk of redundancy. The employer will need to explain:

- that there is possible risk of redundancy and the reason why this may be necessary

- how many redundancies the business is considering

- what the next stage is and how the consultation process will be carried out

Employees should be encoraged to ask questions that they have surrounding the redundacies.

At this stage, each employee who is at possible risk of redundancy should also be informed in writing explaining that they are at risk and whether there are any other options available to them such as voluntary redundancy or redeployment. It is also important to document and outline the consultation process and how this will work.

Employees should be kept up to date and informed throughout the redundancy process.

Employers who propose to dismiss as redundant 20 or more employees at one establishment have a statutory duty to consult representatives of any recognised independent trade union, or if no trade union is recognised, other elected representatives of the affected employees.

You must hold consultation meetings with your employees before finalising any redundancies. If an employee has not been given the chance to have genuine consultation meetings and ask questions etc before redundancy decisions are made, they could claim to an employment tribunal for unfair dismissal.

Unfair dismissal for redundancies

An employee will be deemed to have been unfairly selected for redundancy for the following reasons:

- participation in trade union activities

- carrying out duties as an employee representative for purposes of consultation on redundancies

- taking part in an election of an employee representative

- taking action on health and safety grounds as a designated or recognised health and safety representative

- asserting a statutory employment right

- by reasons of discrimination

- maternity-related grounds.

Selection criteria

To ensure that employees are not unfairly selected for redundancy, the selection criteria should be objective, fair and consistently applied to all staff at risk.

Examples of selection criteria could include:

Employers should explore all options to consider whether employees likely to be affected by redundancy could be offered suitable alternative work within the organisation or any associate company.

Employees who are under notice of redundancy and have been continuously employed for more than two years may also qualify for a reasonable amount of paid time off to look for another job or to arrange training.

The right to a redundancy payment

Employees who have at least two years’ continuous service qualify for a redundancy payment.

The entitlement is as follows:

- For each complete year of service until the age of 21 – half a week’s pay

- For each complete year of service between the ages of 22 and 40 inclusive – one week’s pay

- For each complete year of service over the age of 41 – one and a half weeks’ pay.

A week’s pay is that to which the employee is entitled under his or her terms of contract as at the date the employer gives minimum notice to the employee.

The maximum statutory limit for a week’s pay is £544 from 6 April 2021, and the maximum service to be taken into account is 20 years. This means that the maximum statutory payment cannot exceed 30 weeks’ pay or £16,320.

Employers may, of course, decided to pay in excess of the statutory minimum. The employee is also entitled to a period of notice or payment in lieu of notice by statute and their contract of employment.

Redundancy payments should be made no later than the affected employee’s final pay day. You can pay later than this or by monthly installments if both parties agree in writing.

| For any help or business advice, please do not hesitate to contact us. |